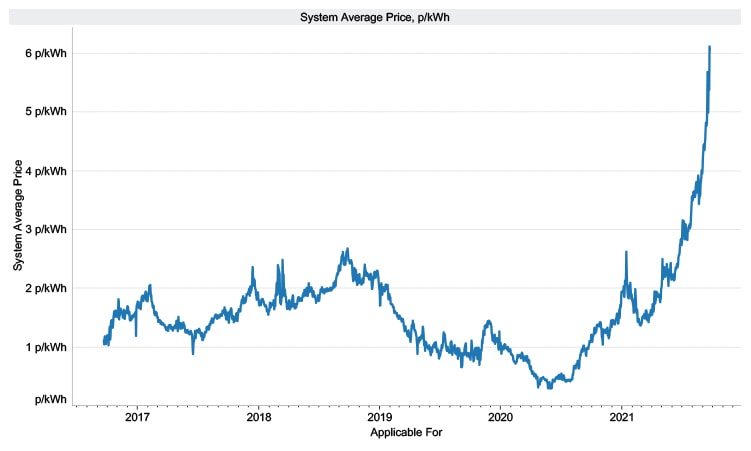

The price spike in natural gas is driven by the increase in international prices for natural gas from mid 2020 (Figure 1) and could theoretically have happened anytime over preceding years if market conditions had pushed prices higher. For gas purchasing, the UK has a market-based framework that allows gas suppliers to purchase hedged contracts against price increases, or to buy through the spot market, or a combination of both. The severity of the price increases coupled to a cap on the price that suppliers can charge customers (the OfGEM price cap) means that many suppliers are simply unable to pass on the price increases of their gas purchases to their customers. The price cap is increasing, but demonstrably not fast enough, or to a great enough level to allow the companies going into administration to remain financially viable.

Figure 1 - Line graph showing a rapid increase in the price for natural gas over this year.

Figure 1 - Line graph showing a rapid increase in the price for natural gas over this year.

There are various views on why the increases in price have happened including:

- the thought that in country gas storage around the world was starting from a lower point in 2021 than in previous years, i.e., more demand from storage to get it back

- the impact of the freeze on the Texas electrical grid had a knock-on effect of a reduction in LNG exports

- the pandemic meant that typically maintenance schedules have had to be delayed until this year

- there has been an increase in economic activity around the world as countries exit from pandemic measures

- there has been a decrease in natural gas from Russia to Europe over the summer

The reality is that there are a range of views and opinions on the reasons underlying the price increases, and thus how structural or temporary these price increases might be.

Regardless of the reasons, there is also a view that if the UK can afford the prices for natural gas, then the international market will continue to supply the UK with natural gas. Thus, in simple terms, there is not a lack of natural gas internationally, there is a lack of lower cost natural gas internationally, which means that the increased costs have to be borne somewhere. There is an understandable political element to this, as there always is with increasing costs of energy bills.

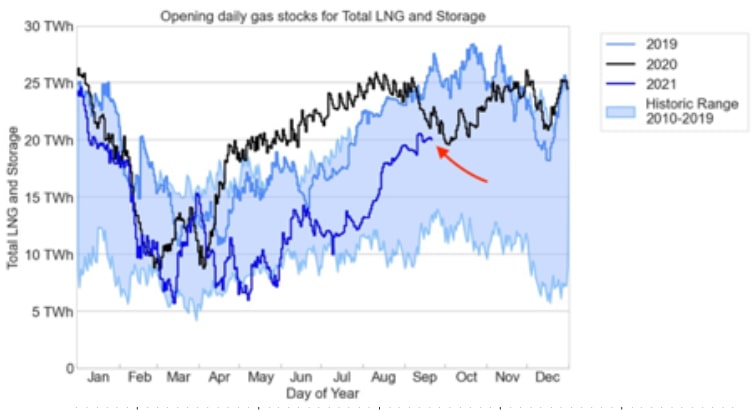

Natural gas in storage in Great Britain

Figure 2 shows the amount of gas in storage in 2021 (the dark blue line) is well within the bounds of an historic range from 2010 – 2019. Note, this does not include the Rough seasonal store in the historic range, as this closed in early 2018. The energy content of the gas in Liquified Natural Gas (LNG) storage and of medium-term gas storage combined is 20 TWh.

Figure 2 - Line graph showing that the amount of gas in storage in 2021 is well within the bounds of an historic range from 2010-2019.

Figure 2 - Line graph showing that the amount of gas in storage in 2021 is well within the bounds of an historic range from 2010-2019.

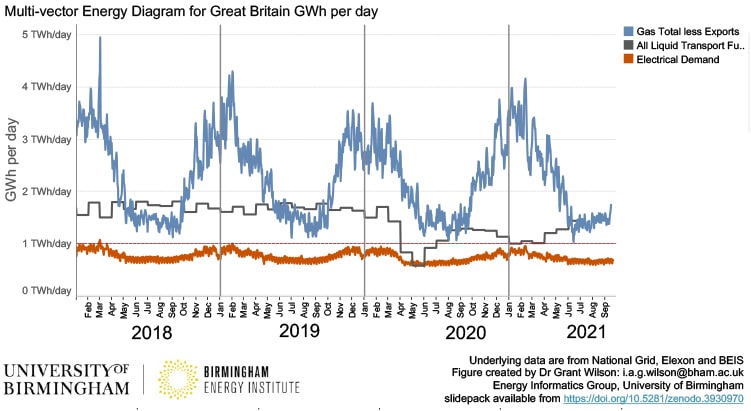

Natural gas demand in Great Britain

At the end of the summer period of 2021, the total daily gas demand is around 1.5 – 2 TWh per day (the blue line in Figure 3). At current System Average gas prices of 6 p/kWh this equates to the daily cost of gas (before transmission / distribution costs, VAT and company overheads etc.) of £90 to £120 million. However, the heating season is about to start as the temperatures in Britain drop into and through the winter period, which significantly increases the amount of natural gas for space heating. Thus, by the end of the year (within the heating season), total gas demand will have increased to a typical range of between 2.5 TWh and 3.5 TWh per day. Or £150 - £210 million pounds per day if the price is still at 6 p/kWh. To put this into perspective, this is broadly three to six times the wholesale cost for gas over winter period of the previous few years.

Figure 3 - Line graph showing that gas demand is highly seasonal – with more demand in winter than summer – and we are just about to enter the time of year when gas demand increases due to colder weather.

Figure 3 - Line graph showing that gas demand is highly seasonal – with more demand in winter than summer – and we are just about to enter the time of year when gas demand increases due to colder weather.

Policy considerations

There are shorter term targeted policy interventions that could be considered, e.g., using the Warm Homes Discount Scheme to provide greater amounts of support to households less able to bear the costs of energy price increases this winter.

There are also calls for a wider assessment of the number, size, scale of suppliers in the market, and the market framework itself in terms of the implementation of a price cap, and what risks this brings to suppliers, and how it aligns with encouraging competition.